Gift Voucher Sales Revenue

After selling a gift voucher, looking at your end of day, you may be unaware of where the revenue has gone. This article will explain exactly how SPARK will process gift voucher sales.

First, we have to fully understand what "revenue" refers to. According to the UK Generally Accepted Accounting Principles (UK GAAP) and International Financial Reporting Standards (IFRS), revenue should be recognised when it is earned and can be reliably measured. This means that revenue should not be recognised until the seller has fulfilled its obligations to the customer. In the case of gift vouchers, the sale of the voucher itself is not the fulfilment of an obligation; rather, it represents a liability to provide goods or services in the future.

This is what is known was "Deferred Revenue" Gift vouchers represent a liability on the company's balance sheet because there is an obligation to provide goods or services when the voucher is redeemed. Until that redemption occurs, the value of the gift vouchers sold should be recorded as deferred revenue. This is in line with the accrual accounting method, which is widely used in the UK.

Once the gift voucher has been redeemed, only then will you see the information added to you daily net revenue.

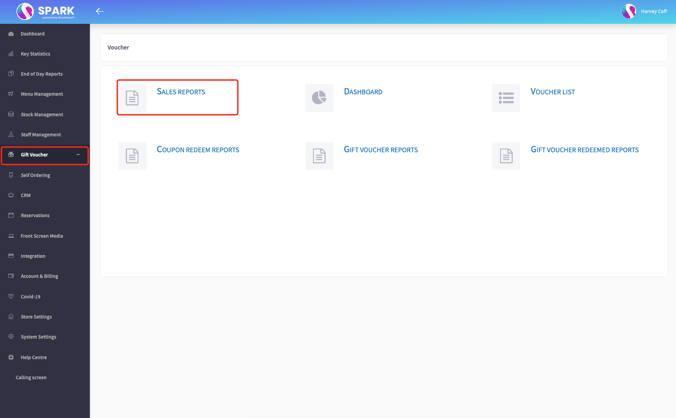

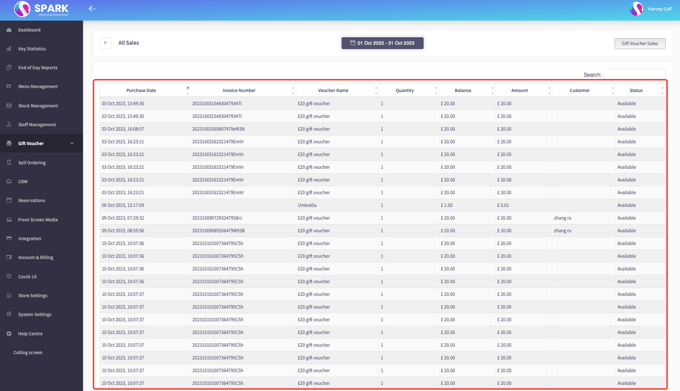

For all information regarding the sales of gift vouchers, this can be found on the back office. Here will give you the details of each individual gift voucher sold, with the order number, and the current balance of said voucher. To Access this information, head to the back office, and select Gift Vouchers

Inside Sales Reports you'll find all the information you need, with custom date ranges to ensure you're getting the data you require.

You can refer to the UK GAAP or IFRS accounting standards for detailed guidance on revenue recognition. It's important to ensure that your system accurately tracks and records gift voucher sales as deferred revenue until redemption. Once a gift voucher is redeemed, the revenue should be recognised in your daily net revenue calculations.